Discover Munich Re's journey to a 90% reduction in monitoring time, transitioning from a complex mix of tools to Aporia's streamlined, powerful platform.

Reduction

Months

Minutes

To observe production models

Overview

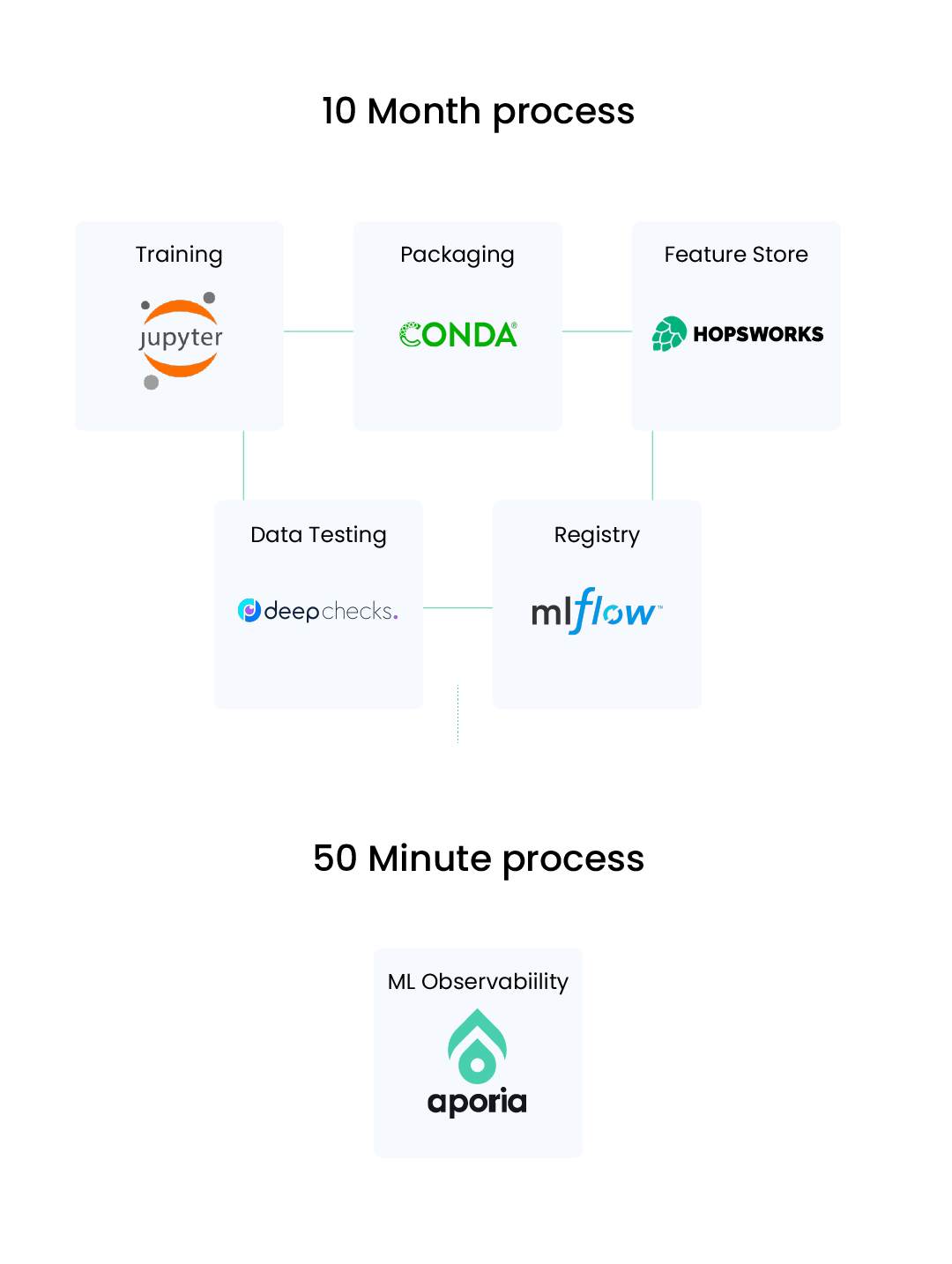

Before partnering with Aporia, Munich Re, a global leader in reinsurance, faced a significant challenge in monitoring their complex ML systems. Their process was fragmented, relying on a combination of Power BI, Grafana, Prometheus, and a custom-built solution. This not only led to inefficiencies but also demanded extensive maintenance time and resources.

The shift to Aporia marked a turning point. Aporia’s advanced, integrated monitoring platform allows Munich Re to integrate all of their disparate systems into one cohesive, efficient tool. This transition resulted in a staggering 90% reduction in the time spent on monitoring tasks. Aporia’s solution provided Munich Re with a more streamlined, user-friendly, and robust monitoring experience, enabling their team to focus on and scale core business activities rather than maintaining multiple systems.

Aporia's solution offered a streamlined and integrated approach. By automating and simplifying the monitoring process, Aporia eliminated the need for manual setups and disparate monitoring tools.

Magd Bayoumi | Senior Machine Learning Engineer at Munich REkey Facts

Company

Munich RE

Industry

Insurance

About

Munich Re is one of the world’s leading providers of reinsurance, primary insurance and insurance-related risk solutions. The group consists of the reinsurance and ERGO business segments, as well as the capital investment company MEAG. Munich Re is globally active and operates in all lines of the insurance business.

Challenges

Munich Re is one of the world’s leading providers of reinsurance, primary insurance and insurance-related risk solutions. The group consists of the reinsurance and ERGO business segments, as well as the capital investment company MEAG. Munich Re is globally active and operates in all lines of the insurance business.

Solution

The decision to move to Aporia was driven by the need for a more integrated, efficient approach to monitoring. Munich Re conducted an evaluation across several vendors, ultimately choosing Aporia for its ease of deployment, maintenance, and excellent support during the proof of concept stage. Aporia stood out for its ability to provide a unified view of technical and business metrics, simplifying the monitoring process and reducing the time spent on these tasks.

Aporia’s solution offered a streamlined and integrated approach. By automating and simplifying the monitoring process, Aporia eliminated the need for manual setups and disparate monitoring tools. This integration allowed Munich Re’s ML team to focus more on high-value tasks rather than getting bogged down by operational complexities.

Impact

1. Significant reduction in time and complexity

The client experienced a dramatic 90% drop in the time spent on monitoring their systems. This reduction was primarily due to Aporia's automation capabilities, which streamlined the process and reduced the need for manual oversight.

2. Unified monitoring and analysis

Before Aporia, the client struggled with disparate systems for business and technical monitoring, making it challenging to get a cohesive view. Aporia unified these aspects, providing a comprehensive overview of both business and technical performance.

3. Focus on high-impact work

With Aporia handling the routine monitoring and maintenance tasks, the client's ML engineers and data scientists could redirect their efforts towards more impactful projects, enhancing productivity and innovation.

4. Enhanced program performance monitoring

Aporia ensured that the client's entire program, including automated risk assessments and related models, functioned as expected. This comprehensive monitoring allowed for quick identification and resolution of any issues.

5. Investigation and bias analysis

Aporia provided tools for investigating biases in models, which was crucial for the client. This feature enabled them to maintain fairness and accuracy in their models, aligning with their focus on bias investigation.

6. Ease of deployment and support

The client chose Aporia over competitors due to its easy deployment and exceptional support during the proof of concept stage. This ease of integration and ongoing support was a significant factor in their decision.

Conclusion

Aporia’s solution has been instrumental in revolutionizing Munich Re’s monitoring processes, aligning their technical operations seamlessly with overarching business goals. By automating and simplifying these processes, Aporia has empowered Munich Re’s ML team to concentrate on adding value through their models and programs, ensuring optimal performance and swift adaptation to changes.

This transformation from a fragmented, labor-intensive system to a cohesive, efficient, and integrated approach has not only led to a significant 90% reduction in monitoring time but also enabled Munich Re to focus on innovation and strategic business initiatives. This case study stands as a compelling example of how the right technological solution can drastically enhance operational efficiency and the ability to effectively meet and exceed business needs.

This transformation from a fragmented, labor-intensive system to a cohesive, efficient, and integrated approach has not only led to a significant 90% reduction in monitoring time but also enabled Munich Re to focus on innovation and strategic business initiatives.

What Clients Don’t Need to Worry About Anymore with Aporia

Manual Monitoring and Maintenance

Aporia's automation capabilities eliminated the need for extensive manual monitoring and maintenance, freeing up time for the client's team.

Disparate System Management

The client no longer had to manage separate systems for business and technical monitoring, as Aporia provided a unified platform.

Complex Data Integration

Previously, integrating and exporting metrics to different systems like Prometheus and Grafana was a challenge. Aporia simplified this process, making it more efficient and less error-prone.

Delayed Responses to Business Queries

With Aporia, the need for manual database queries and delayed responses was eliminated, allowing for quicker and more efficient decision-making.

Constantly Checking for Model Drift or Anomalies

Aporia's monitoring tools automatically detect model drift and anomalies, alerting the team only when necessary. This feature allows the team to focus on other tasks without constantly worrying about model performance.

Bias Investigation Complexity

Aporia provided tools to easily investigate and address biases in models, a task that was previously more complex and time-consuming.

In summary

Aporia significantly reduced the time and complexity of monitoring for the client, unified disparate monitoring systems, and allowed the team to focus on high-impact work. It also provided comprehensive program performance monitoring, including bias analysis, and offered ease of deployment and strong support. This led to the client not having to worry about manual monitoring, complex data integration, delayed business responses, constant model performance checks, and complex bias investigations.